pay indiana unemployment tax online

By using our on-line registration system you will be able to. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers.

How To File Taxes For Free In 2022 Money

Electronic Payment debit block information.

. Bank Account Online ACH Debit or Credit Card American Express Discover. Well the first 10200 is excluded from income on the federal tax return. Form WH-3 Annual Withholding Tax return is to be filed each year by February 28.

Unemployment Insurance is a program funded by employer contributions that pays benefits to workers who are unemployed through no fault of their own. Taxpayers may still be able to deduct some portion of their unemployment income on their state tax return in accordance with Indianas current tax laws. As a result Indiana taxpayers cannot use the federal unemployment compensation exclusion on their 2020 Indiana individual income tax returns and that income must be added back in.

The employer handbook has almost everything an employer needs to know about unemployment insurance. If you cannot find what you need in the Employer Handbook you can contact us during regular business hours at 8008916499. For a list of state unemployment tax agencies visit the US.

This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. Select the Payments tab from the My Home page. Registering for an Indiana State Unemployment Tax Account.

For more information call 317 232-5500. Unemployment Tax Payment Process. If you cannot locate this number please call the agency at 317-233-4016.

In Indiana the new employer SUI state unemployment insurance rate is 250 percent on the first 9500 of wages for each employee. Indiana University professor Greg Geisler says the federal government has exempted a portion of the unemployment benefits from federal income taxes. If you have questions about employer requirements please refer to the Employer Handbook.

Please use our Quick Links or access on the. If your small business has employees working in Indiana youll need to pay Indiana unemployment insurance UI tax. Online Payment Service by VPS.

Please use the following steps in paying your unemployment taxes. Other important employer taxes not covered here include federal UI tax and state and federal. To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments from T356000158 are authorized for Indiana SUTA payments.

If you expect to have income during the tax year that. The UI tax funds unemployment compensation programs for eligible employees. You will receive your Tax ID within a few.

Find out how to pay estimated tax. While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience. Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status.

You also can file a wage report online or adjust a filed wage report online. Business entities that have paid wages in Indiana and met employer qualifications are required to register with the Indiana Department of Workforce Development. Register online with the Indiana Department of Revenue on INBiz.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Paid 1500 in wages in a single calendar quarter or employed one or more persons for 20 weeks in a given calendar year. Select a payment option.

INTAX only remains available to file and pay special tax obligations until July 8 2022. Visit the Indiana Department of Workforce Development to learn more about filing for unemployment andor signing up to have Indiana State and county tax withheld. In Indiana state UI tax is just one of several taxes that employers must pay.

Department of Labors Contacts for State UI Tax Information. EFT allows our business customers to quickly and securely pay their taxes. Most employers pay both a Federal and a state unemployment tax.

File online using IN Tax. Register with the Indiana Department of Revenue. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

INDIANAPOLIS With over 12 million unemployment claims in 2020 more Hoosiers than ever will be including unemployment income for the first time when filing their 2020 individual income tax return. Overtime pay is not required for live-in employees. Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and.

Logon to Unemployment Tax Services. All payments are processed immediately and the payment date is equal to the time you complete your transaction. Employers paying by debit or credit card should authorize 9803595965 and 1264535957.

Make payments by e-check and credit card The Uplink Employer Self Service System provides you with immediate access to services and information. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. This way you wont need to pay all your tax at one time when you file.

Household employees in Indiana are required to be paid at least time and a half for hours worked over 40 in a seven-day workweek. Paid 1000 in cash wages in one calendar quarter for domestic work. Form WH-1 Withholding Tax Voucher for EFT Early Filer Early Filer Monthly Annual filers.

Services Topics Agencies Calendar. You can find your Indiana Tax ID number on notices received from the Indiana Department of Revenue. The Indiana Department of Revenue DOR is reminding individuals that unemployment benefits are taxable income on both state and federal returns.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. Indiana State Unemployment Tax Rate. Please DO NOT attempt to register until wages have been paid.

To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. Put some money back to ensure you are able to pay your taxes. To learn more about the EFT program please download and read the EFT Information Guide.

If you are an employer with an existing SUTA account number be sure to check the Yes option button on the first screen you see after clicking New User on the ESS logon screen. Most for-profit employers are required to pay contributions taxes as soon as they have. File online using IN Tax.

How To Do Your Taxes In 2022 Cbs News

Pay Your Federal State Taxes On Efile Com Debit Check

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

It Has The Professionals To Provide The Services At Cheap Rate And Fast To Meet The Deadline Of The Payment Of Taxes Tax Attorney Tax Lawyer Tax Refund

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Ess Employer Self Service Logon

Deluxe Online Tax Filing E File Tax Prep H R Block

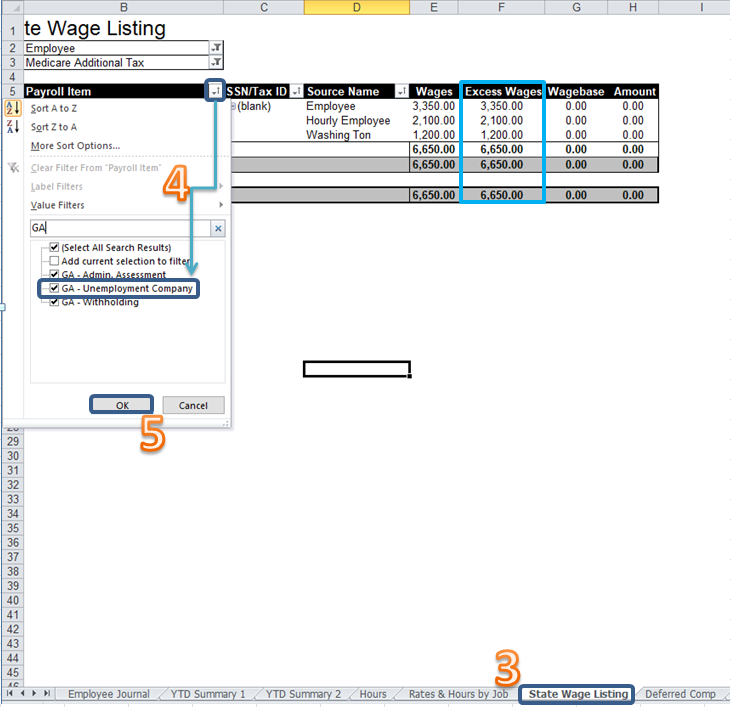

I Have State Unemployment Taxes Showing Up That Ar

Dor Important Tax Information About Your Unemployment Benefits

Expert Tax Filing Services Our Products Paylocity

Secure Login Access Http Www Netankiety Pl The University Alliance Login Here Secure User Login To Univers Places To Visit I Am Awesome Interesting Reads

Solved Creating State Sui E File

Indiana Form Uc 1 Updates Tax Alert Paylocity

I Have State Unemployment Taxes Showing Up That Ar

Solved State Unemployment Insurance Q4 Online Report Pa

Enjoy Casino Games Enjoy The Thrill And Excitement Of Winning Br Farm N Trade Is The Game For You Farm N Tr Make Real Money Trading Stock Options Trading

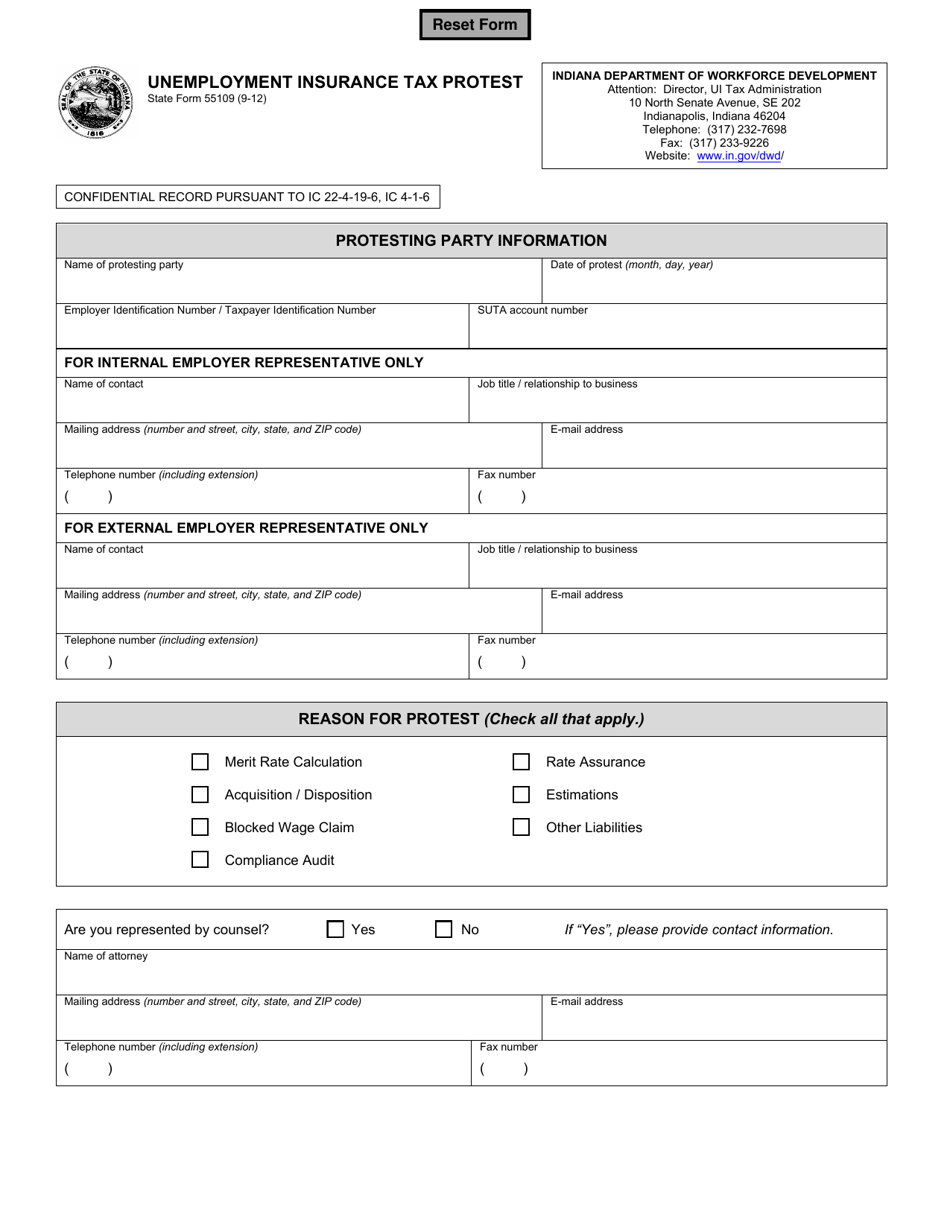

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller